new mexico pension taxes

Finally in New Mexico as with most states teacher pensions are not portable. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income AGIis less than 28500 for single filers 51000 for married people filing jointly and.

New Mexico Retirement Tax Friendliness Smartasset

NMERB previously coded these 1099- Rs with a 2.

. New Mexico Veteran Financial Benefits Income Tax. Michelle Lujan Grisham a Democrat signed House Bill 163 exempting. New Mexico does not however require the payors of such income to withhold New Mexico income tax unless requested to do so by the recipients of the payments.

New Mexico State Senator Bill Burt R-Alamogordo reintroduced legislation Tuesday to provide a new phased-in personal income tax deduction for military retirement income of uniformed service retirees or surviving spouses according to a press release. New Mexico does have a sales tax as well. Rules for filing taxes in New Mexico are very similar to the federal tax rules.

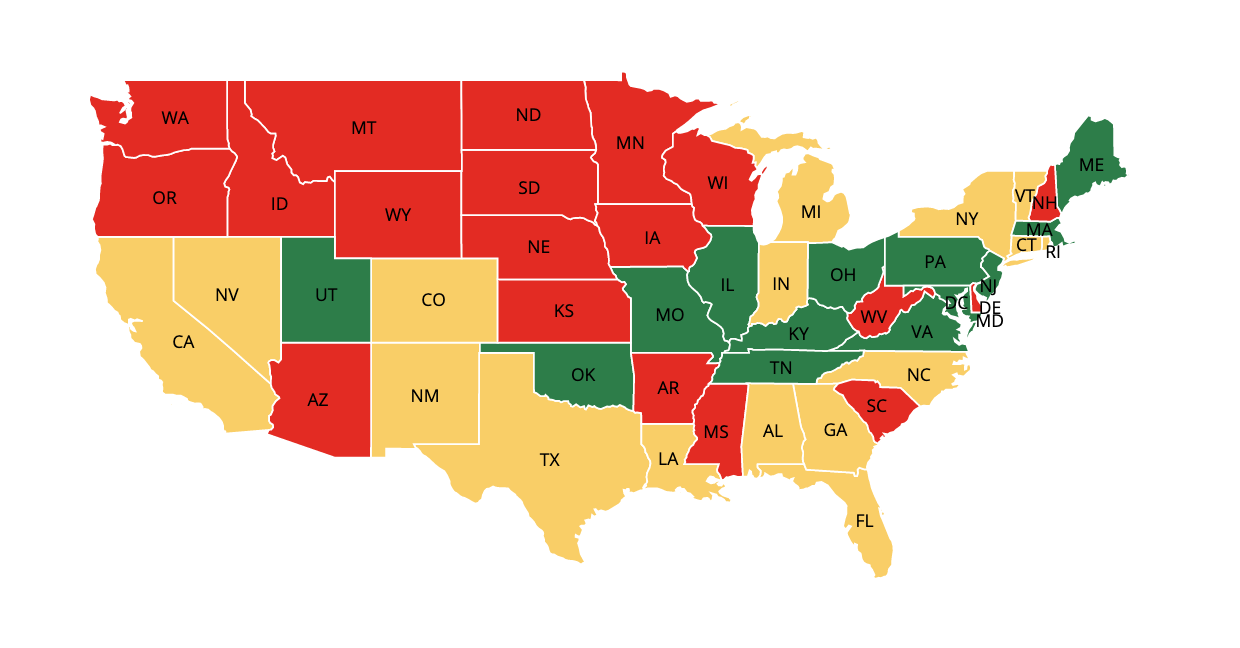

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. The income of New Mexico residents from pensions and annuities is subject to New Mexico personal income tax. 52 rows 40000 single 60000 joint pension exclusion depending on.

Confidentiality of Tax Return Information. For tax year 2021 that means single filers can claim a standard deduction of 12550 and joint filers can claim a standard deduction of 25100. Any veteran who rated 100 service-connected disabled by the VA can get a.

Tax Analysis Research Statistics. The New Mexico Legislature on Thursday passed a bill eliminating taxes on Social Security benefits for individuals with less than 100000 in annual income or couples with less than 150000 in. Depending on income level taxpayers 65 years of age or older may be eligible for a.

Marginal Income Tax Rates. However cities and counties can levy additional taxes pushing some local rates above 9. Ad Could increased liquidity give you more control over your 500K in retirement savings.

If you are a New Mexico Educational Retirement Board NMERB retiree who is under the age of 55 please note. You are 65 or older. Does New Mexico offer a tax break to retirees.

You are not 65 but are considered blind for federal tax purposes. Military pensions might be eligible under this exemption. The 1099-R tax document for retired members were mailed January 27 2021.

It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500 or less for singles to deduct up to 8000 in income that can be applied to benefits. The base state sales tax is set at 5125 percent. There is a modest reduction in taxes for people 65 or over with incomes less than 51000 couples.

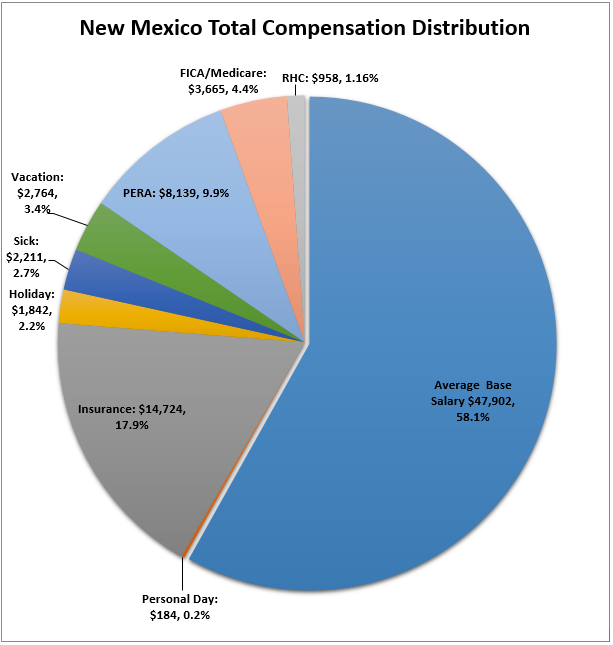

Disabled Veteran Tax Exemption. The remaining 178 percent state contribution is to pay down the pension funds debt. Active duty military pay is tax-free.

All NM Taxes. Year after year we hear from employers that they cannot find qualified staff. Is my retirement income taxable to New Mexico.

Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. NMERB is required to use the code 1 on your 1099-R. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted gross income if you meet one of the following.

SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support. When this reform is signed it will save middle and low-income seniors 84 million this tax year rising to 995 million by 2025. Property Tax Rebate for Personal Income Tax.

New Mexico is moderately tax-friendly for retirees. Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. While the full 107 percent of salary contributed by individual teachers is for benefits the state contributes only 298 percent.

The bill would support retired veterans by making up to 30000 of their military retirement pay exempt from state income tax. New Mexico lawmakers introduce bill to eliminate taxes on social security income. Ad File 1040ez Free today for a faster refund.

By exempting veterans retirement pay from state income tax they can keep more of what they earned for their selfless. Forming Tax Increment Districts. Approximately 86 of New Mexico seniors will qualify for the exemption and the average senior will save around 710 a year.

Deductions both itemized and standard match the federal deductions. ALBUQUERQUE New Mexico KOAT Republican lawmakers are looking to eliminate a tax for retirees. The New Mexico income tax has marginal rates from 17 to 49 on a couple with 24000 income.

How Taxes Can Affect Your Social Security Benefits Vanguard

Retirement Security Think New Mexico

Your New Mexico Income Taxes Can Be Efiled Here At Efile Com

New Mexico Retirement Tax Friendliness Smartasset

Montana Retirement Tax Friendliness Smartasset

Retirement Security Think New Mexico

New Mexico Estate Tax Everything You Need To Know Smartasset

37 States That Don T Tax Social Security Benefits The Motley Fool

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

Solved Lance H And Wanda B Dean Are Married And Live At Chegg Com

Retirement Eligibility Nm Educational Retirement Board

Effort To Eliminate Social Security Tax Gains Momentum The Nm Political Report

Retirement Security Think New Mexico

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Where S My State Refund Track Your Refund In Every State

New Mexico Estate Tax Everything You Need To Know Smartasset